The art of the possible

Explore real-world examples of Tellius agentic workflows across industries—showing how AI agents automate analysis, generate insights, and solve complex problems.

Agentic flows are intelligent, modular analytics processes composed of AI Agents that understand your questions and deliver insights without writing a single line of code.

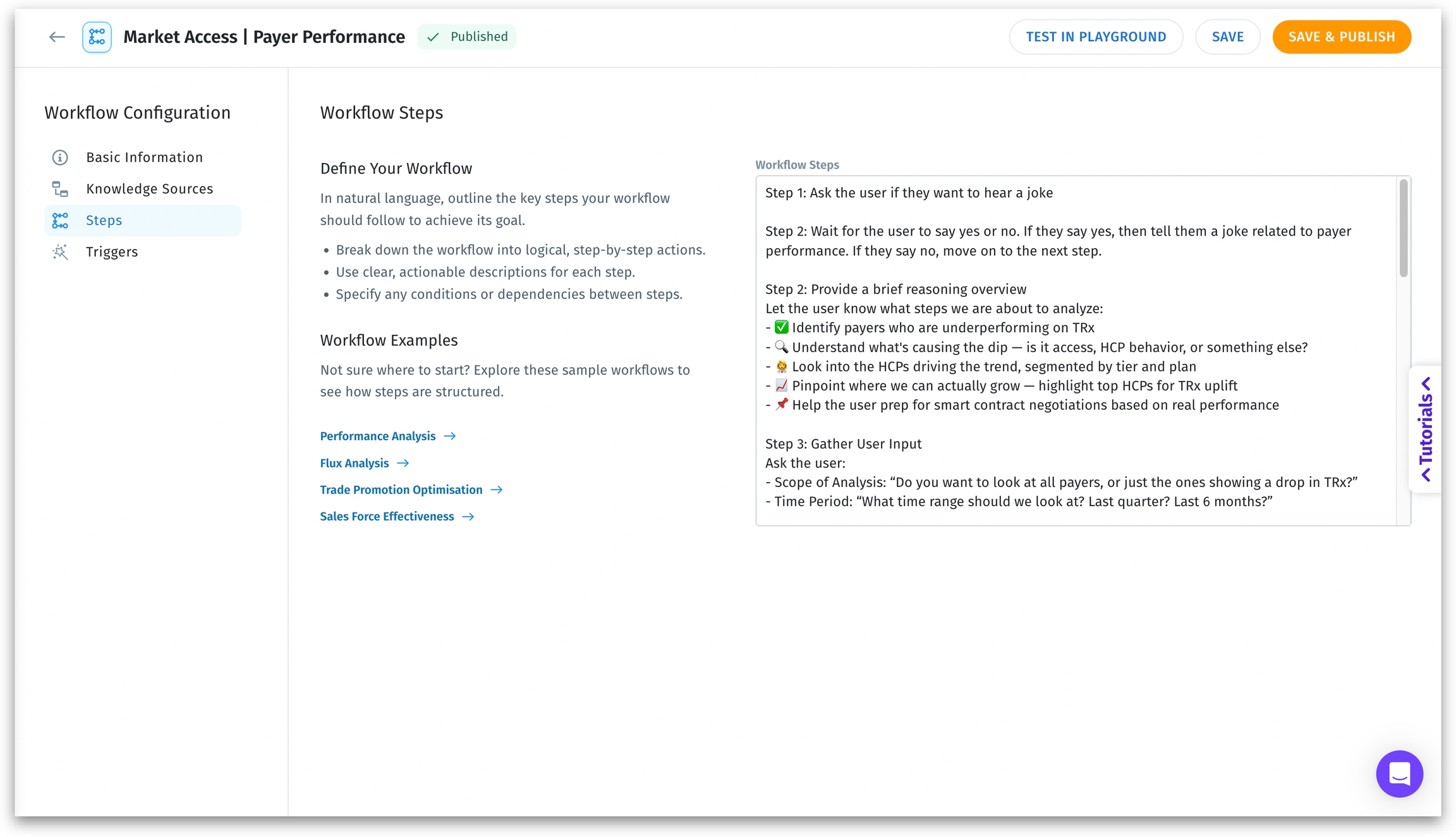

The Steps section in Composer lets you describe any workflow like the ones below in natural language. Our AI agents will do the rest: gather the relevant data, run the analysis, generate visuals, and surface insights.

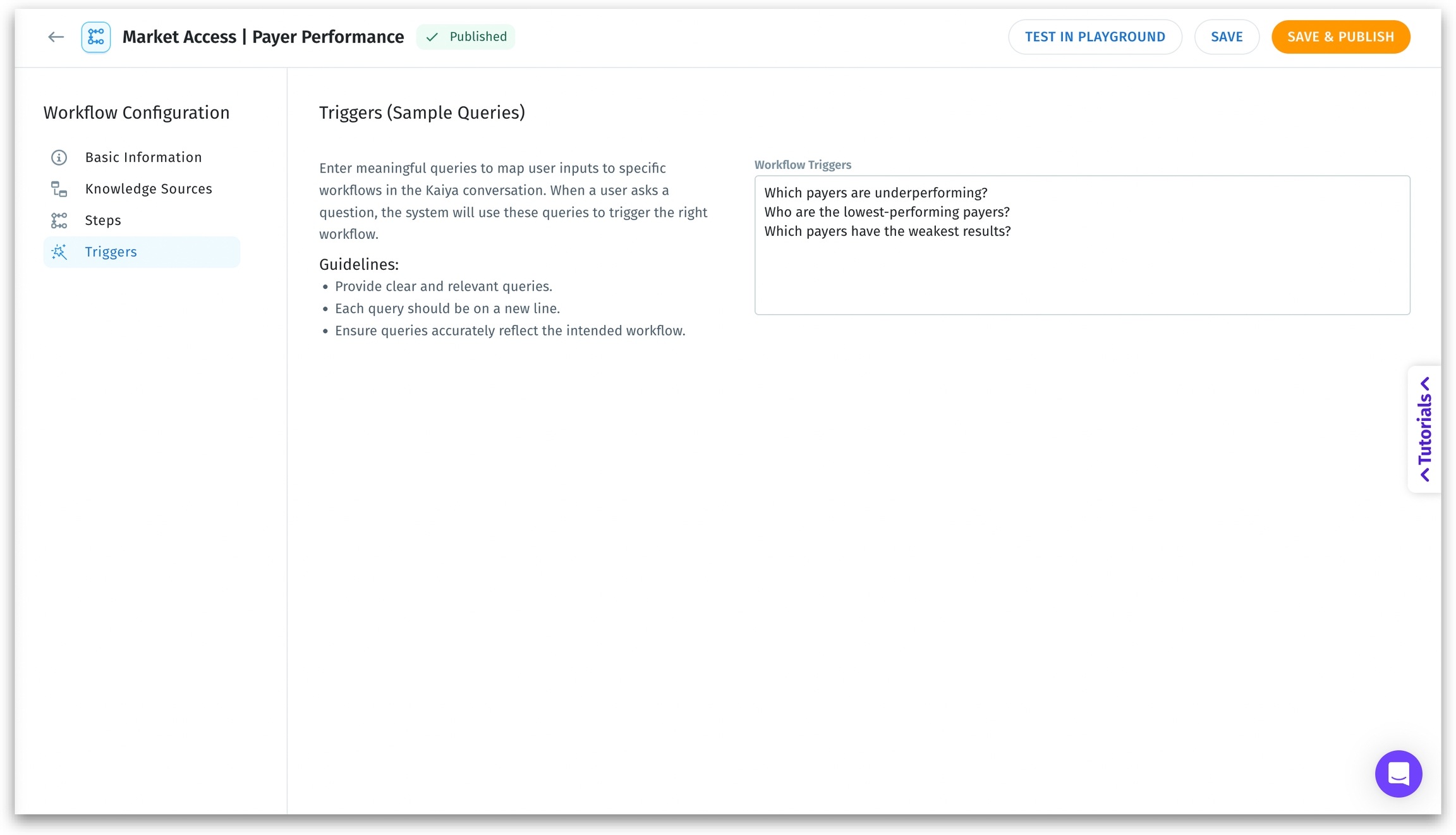

Each workflow becomes a living, reusable intelligence asset in your Agent Library, ready to trigger when you (or anyone in your team) asks the right question (as mentioned in the Triggers section).

Below are real, industry-relevant examples showing what you can build—organized by use case domain.

💊 Pharma & Life Sciences

Which payer plans are underperforming on TRx and why?

Analyze payer plans underperforming on TRx, segment by access restrictions or HCP tiers, and suggest data-backed contract renegotiation points.

Why is our new product launch lagging in key territories?

Identify territories or HCPs (Health Care Professionals) where a new launch is lagging, then break down messaging gaps, rep engagement, or access barriers.

What’s driving the recent drop in market share for Brand X?

Investigate market share erosion by segment, uncover if it's driven by new competitors, loss of exclusivity, or formulary exclusion.

Why is a high sampling rate not translating to scripts?

Analyze sampling and TRx data together to pinpoint why high sample volume isn't translating into prescriptions, by HCP or specialty.

💰 Finance & FP&A

What’s causing the variance between actuals and forecast this quarter?

Automatically compute and visualize variances by department or cost center and identify drivers like overspend in labor or marketing.

Which teams or vendors are causing invoice delays?

Track invoice approval SLAs, highlight vendors or departments causing delays, and suggest automation or escalation points.

Why are our margins shrinking despite stable revenue?

Break down decreasing margins by region or SKU and isolate root causes like price cuts, cost increases, or channel mix shifts.

🛒 Retail & CPG

Which products should we discontinue to boost margin and reduce clutter?

Identify underperforming SKUs with low margin and high cannibalization impact, and generate a shortlist for discontinuation.

Did our last trade promotion actually drive incremental sales?

Measure uplift from trade promotions by channel or retailer and highlight where discounting didn’t drive incremental sales.

Why are we consistently facing out-of-stock issues for Product Y?

Track and explain frequent stockouts at a product or store level, connecting issues to supplier lead times or DC inefficiencies.

💼 Sales

Which reps are underperforming in high-potential territories?

Match rep performance to territory opportunity, flag underperformers in high-potential areas, and suggest redeployment.

Where are deals stalling in the pipeline and why?

Identify pipeline leaks by stage, region, or deal owner and determine whether the issue is conversion, qualification, or velocity.

Why did Region A miss their sales target this quarter?

Analyze why certain reps or teams missed quota—whether due to low volume, high-value deal loss, or lack of activity.

🚚 Operations & Supply Chain

Which warehouses or carriers are failing our delivery SLAs?

Track late deliveries, segment by carrier or warehouse, and surface which combinations are failing SLA the most often.

Where do we have excess inventory building up?

Identify aging or excess inventory by category, link to misaligned demand forecasts, and quantify holding costs.

Why are our supplier lead times increasing?

Highlight vendors with increasing lead times, compare to historical norms, and recommend vendor evaluation or escalation.

🏦 Banking & Insurance

What’s slowing down our claims approval process?

Diagnose delays in claims processing by team or system bottlenecks (manual review, missing info etc.), and suggest routing or staffing optimizations.

Which customer segments are showing high churn risk?

Use attrition analytics to flag customer segments with high churn risk, identify shared behaviors, and suggest outreach.

What’s behind the spike in fraudulent transactions this week?

Break down recent fraud spike by transaction type, location, and device to find patterns and recommend rules.

🌐 E-commerce & Digital Business

Why are customers abandoning carts before checkout?

Analyze drop-offs by device, page load times, and payment method to pinpoint why customers abandon checkout.

Why are return rates spiking for certain products?

Break down return reasons by product, geography, or channel to find quality or sizing issues affecting profitability.

Why did our latest email campaign underperform?

Understand why open or click rates dropped—by send time, device, campaign type—and test alternatives.

🧑🤝🧑 HR & People Analytics

Why are employees leaving our company in higher numbers?

Segment leavers by department, tenure, and performance score to uncover common causes behind churn.

Where are we losing candidates in the recruitment funnel?

Track where candidates drop off in the hiring process and determine whether it's role fit, offer rejection, or slow feedback.

Why are overtime costs rising in certain departments?

Identify teams or locations where overtime is growing unsustainably, and highlight workload or staffing issues.

Was this helpful?